There are certain key factors in each market that are vital indicators of what the market is doing at any given time. In this series, I’ll highlight 5 indicators and how to interpret each one’s market effect. Although forecasting is not an exact science, use this information and you’ll be well on your way to making educated apartment investing decisions and maximizing your wealth.

Rental Rates

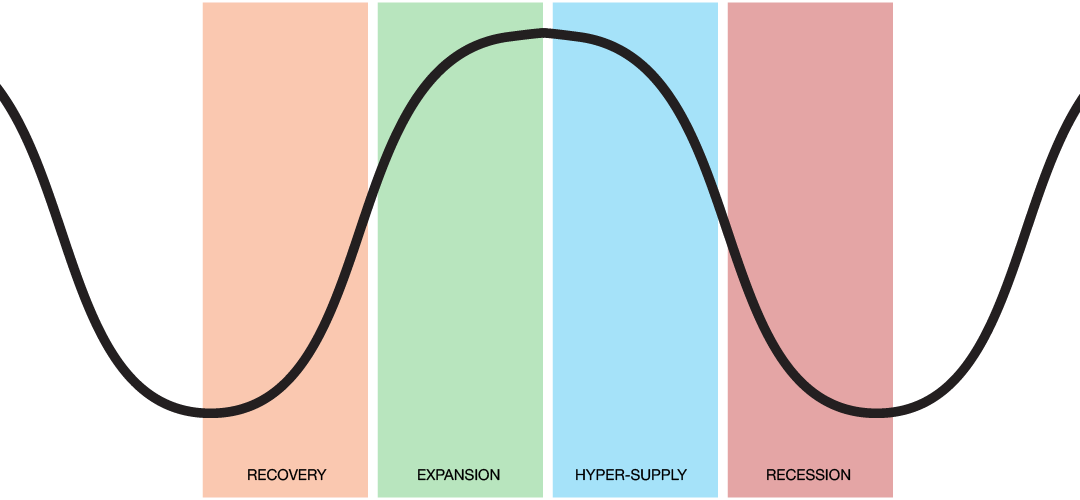

Take a look at the current rents that are being collected. Are they increasing, decreasing or stagnant? A good market is one in which rents have begun to slowly increase. This is an indication that the market may be in transition into the absorption phase. Decreasing and stagnant rents are an indication that the market may be in the hyper-supply phase. If you are not sure what the rents are doing in a particular market, contact the local apartment owner’s association or a local commercial real estate agency.

Demographics

Look at the demographic mix of a community. Factors that you want to see in the market that you are researching that would lead to a higher number of potential renters include:

- Higher female to male population

- Higher population of young and old versus middle age

- More singles versus married

- More smaller families versus larger families

- Higher amount of renters versus non-renters.

Vacancy Rates

When vacancy rates are down, this is potentially a good market to be buying in. Although vacancy rates alone cannot determine whether or not you should be buying in a particular market, you may want to seek out markets that are experiencing higher than normal vacancies. If vacancies are up, that means the net income for the complex is down. If the net income is down then property values are down and you should be buying at lower prices. You want to be sure that you are buying in an absorption phase. If the market is still in decline, it may be a long time before you can fill those vacancies and make any money. When vacancies are at their lowest point, this may be the time to sell since this is when you will be getting your highest price for the property. Check with the local chamber of commerce or local commercial real estate agencies to gauge local vacancy rates.

Employment

The best indicator of a buyer’s market is employment More importantly, job growth. You want to look for local governments that are giving tax incentives for companies to re-locate into their area. These areas should have a low cost of living, lower cost of labor and a good quality of life. These factors will entice businesses to move in. Once businesses begin to relocate to these areas, for every job that a new business brings to an area, there will be 3-4 other jobs created in the service sectors. And the upward cycle begins. Contact the department of economic development in the local government of the city that you are interested as request a copy of the city’s strategic economic development plan or report.

Household Income

As household income rises, the ability to pay higher and higher rent also rises. Higher rents mean higher property values. You’ll want to look for areas in which the household income is rising. You may find these areas by the U.S. Census Bureau. Within the city of choice, you want to look for data for income and poverty/mean income for the past 12 months/household when determining the annual trend of either increases or decreases in household income.

Are you interested in learning more about creating turnkey passive income and generational wealth through multifamily apartment investing? Visit www.syndicationcapital.net for more information, resources, frequently asked investor questions and our free e-book: How To Passively Invest In Multifamily Apartment Syndications.